Investing may seem complex at first, but understanding its fundamentals is the first step to financial success.

With the right knowledge, you can build a solid foundation for making informed investment decisions.

Investment is the process of allocating resources, usually money, with the expectation of generating additional income or profit.

When investing, you purchase assets that you believe will increase in value over time.

Invest can be a rewarding path to building your wealth, but it comes with its challenges and pitfalls.

To help you navigate this minefield, we’ll highlight some essential strategies for identifying and avoiding the most common mistakes investors make.

Before making any investment, it is crucial to have a clear understanding of your long and short term financial goals.

This includes knowing why you are investing, what you hope to achieve, and how quickly you want to achieve your goals.

This clarity can help guide your investment decisions and avoid making impulsive choices or ones that are out of alignment with your goals.

Diversification is a technique that reduces risk by allocating investments across multiple classes of financial assets.

Have a diversified portfolio means you won't put all your eggs in one basket, which can protect your assets against specific market volatility.

Knowledge is a powerful tool in the world of investments.

Commit to financial education continuously, whether through reading books, participating in courses, seminars or following relevant content from recognized experts in the field.

Understanding the fundamentals of the market, the different types of investments and strategies can make a difference in identifying and preventing errors.

Your time horizon is the period you expect to hold an investment before needing to access your capital.

Correctly identifying your time horizon can help you select the right investments and avoid the mistake of entering or exiting the market prematurely.

Investment decisions driven by emotions, such as panic, fear or euphoria, often result in mistakes.

Practice the discipline and patience, especially during periods of market turbulence, can help you avoid rash decisions that could harm your long-term investment goals.

Use the reliable tools and resources to monitor your portfolio and conduct market research.

This includes using reputable financial apps, market news sites, and professional advisors when necessary.

Investing smartly requires constant attention to detail and a meticulous approach to avoid common mistakes.

By following these strategies, you can significantly increase your chances of success in the world of investing.

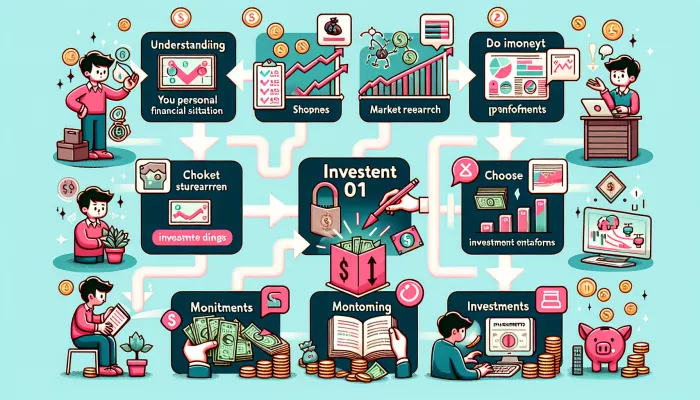

Investing can seem like a daunting journey for newbies, but with smart strategies and informed decisions, you can build a solid foundation for your financial future.

Here are some practical tips designed for beginner investors:

Before diving into the world of investments, it is essential understand your financial goals. Ask yourself what you hope to achieve with your investments.

Whether it’s saving for retirement, buying a home, or funding your children’s education, having a clear goal will help you come up with the best plan of action.

One of the common mistakes beginner investors make is putting a large amount of money at risk without fully understanding the market.

It is more prudent start small and gradually increase your investment portfolio as you gain more experience and confidence.

Knowledge is power when it comes to investing. Take the time to study different types of investments, such as stocks, bonds, mutual funds, and cryptocurrencies.

Utilize online resources such as blogs, podcasts, and courses to familiarize yourself with investment jargon and the latest market trends.

One of the most prevalent pieces of advice in investing is don't put all your eggs in one basket.

Diversifying your portfolio helps reduce risk, as poor performance in one investment can be offset by better results in others.

The investment market is known for its fluctuations. It is essential to remain calm and have a long-term perspective, especially in the face of market volatility.

Consider investments that offer good long-term returns rather than looking for quick gains, which are riskier.

If you are unsure about where to start, it may be helpful to consult a financial advisor.

A professional can offer personalized advice based on your financial goals and current situation, helping you make more informed decisions.

Adopting these practical strategies can help you better navigate the world of investing, minimize risk, and maximize the growth of your portfolio.

Remember that the journey to becoming a successful investor requires patience, continuous learning, and effective risk management.