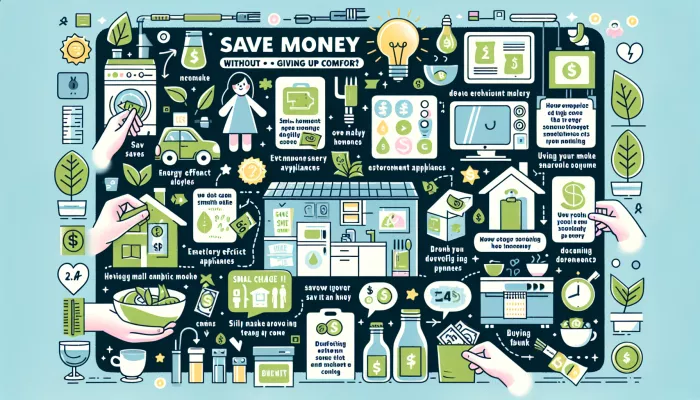

With some strategy and creativity, it is possible to maintain a pleasant lifestyle while saving money. Here are some tips that can make all the difference.

Organize your weekly menu before you go shopping.

This prevents impulse purchases, reduces food waste and allows you to take advantage of supermarket offers in a smart way.

Review your service subscriptions such as streaming, magazines and apps. We are often paying for services that we rarely use.

Canceling or switching to cheaper plans can result in significant savings.

Explore the options free or low-cost entertainment available in your city, such as parks, museums with free admission on certain days, or community events.

In addition to saving money, you diversify your leisure experiences.

If possible, use public transport, go walking, use bicycles or organize a carpooling system with colleagues.

In addition to saving on fuel and parking, you contribute to reducing pollution.

Sustainable practices not only benefit the environment, but also reduce your monthly bills.

Simple things like turning off appliances when they are not in use, reusing rainwater to water plants, or using LED lights make a big difference in household savings.

Develop skills to make small repairs around the house, cook more elaborate dishes or even make your own gifts.

These skills can generate substantial savings over time.

In the search to balance finances without giving up comfort, technology emerges as a powerful ally.

There are several digital tools and innovations that can help you reduce costs in a smart way. Here’s how to take advantage of these solutions.

Home automation systems such as smart lamps, smart thermostats, It is voice assistant, can bring a significant reduction in energy costs.

By automatically adjusting your home's lighting and climate, you not only increase comfort but also save energy.

Use budget apps to manage your finances.

Tools like Mint It is YNAB (You Need A Budget) provide complete visibility over your expenses and income, helping you identify where you can save without affecting your quality of life.

Invest in gadgets that promote energy savings.

Items like solar chargers for mobile devices and smart extensions that automatically turn off appliances on standby can significantly reduce energy consumption.

Explore platforms online financial education free, like the Coursera or Khan Academy.

Learning about personal finance and investing can help you make more informed choices, saving you money in the long run.

In conclusion, integrating technology into everyday life represents an effective strategy for saving money without compromising comfort and quality of life.

By using the right tools, you can achieve an ideal balance between economy and comfort.

Managing personal finances is a constant challenge that requires balancing savings and maintaining a comfortable standard of living. To achieve this, creating a flexible budget is essential.

A flexible budget, unlike a rigid one, allows for adjustments that accommodate unexpected expenses without compromising your ability to save. Here’s how you can create one for yourself:

First of all, It is crucial to fully understand how much money comes into and goes out of your bank account each month. This includes wages, extra income, fixed bills, leisure expenses, and more.

Separate your expenses into categories such as food, leisure, services (internet, cell phone) and emergencies. This way, you can see where you can make adjustments as needed.

Defining what is essential in your life helps you create a budget that reflects your true needs and wants. Health, housing and food expenses are generally a priority.

This rule suggests dividing your expenses as follows: 50% with needs, 30% with wishes and 20% with savings. It's a simple way to stay comfortable while saving money.

Constantly monitoring your budget allows you to make adjustments before your finances get out of control. Use finance apps to help you track your expenses in real time.

The secret to a successful flexible budget is your ability to adapt to changes in your finances without sacrificing your long-term goals, like saving for retirement or a big trip.

Thus, it allows not only financial survival in the present, but also the construction of a prosperous and comfortable future.