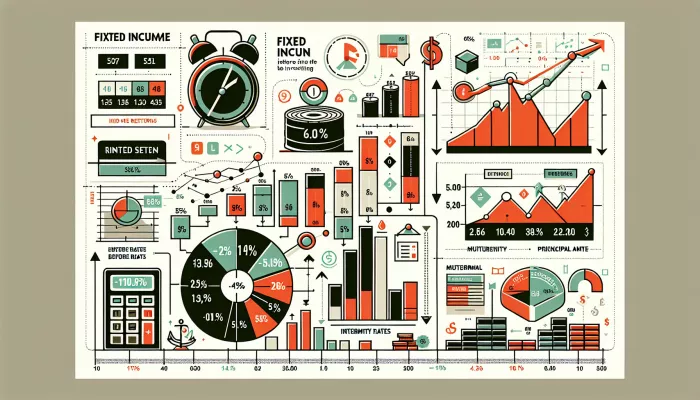

Understanding fixed income returns

A fixed income It is an investment category that has gained prominence, especially in times of economic uncertainty.

She is known for offering greater security and predictability of returns compared to other investment options.

Understanding fixed income returns is crucial for investors planning to build or diversify their investment portfolios.

Fixed income return refers to the profit that the investor obtains by allocating his money in fixed income securities.

This return can be pre-fixed or post-fixed, depending on the type of investment chosen.

The calculation of fixed income returns may vary depending on the type of security. For fixed income securities pre-fixed, the calculation is more direct, based on the rate agreed at the time of purchase.

For titles postfixed, the yield will be the sum of the referenced rate plus the agreed additional rate, if any.

Investing in fixed income is attractive for several reasons:

Understanding the nuances of fixed income returns can help you make more informed investment decisions tailored to your financial goals and risk profile.

For more information and calculation tools, visit:

Calculate the return on your investments is essential to understanding whether you are on the right track to achieving your financial goals.

Follow this guide to learn how to do these calculations simply and effectively.

First of all, identify the type of investment you are making. Equity investments fixed income It is variable income have different ways of calculating income.

Initial capital: the amount you initially invested. Performance: how much your investment earned beyond the initial capital.

For most fixed income investments, the formula is:

Yield = (Initial Capital x Interest Rate x Time) / 100

For variable income investments, it is recommended to use a income calculation application or consult a professional, as the calculations can be more complex.

Subtract taxes and fees from your income to get your net income. This is crucial to understanding how much you actually earned.

Periodically reevaluate your investments. The market is constantly changing, and keeping an eye on your performance helps you make better decisions.

With these steps, you will be well equipped to calculate your investment returns and make informed decisions about your finances.

Don't forget that constant practice and financial education are key to successful investments!

A fixed income It is considered one of the safest investments on the market. However, several factors can influence its return.

Understanding these elements is essential for investors looking to optimize their profits and minimize risks.

The interest rate is one of the main factors that affect the return on fixed income. When interest rates are on the rise, the new bonds issued offer better returns.

On the other hand, if the interest rate falls, the market value of pre-existing securities increases, boosting profits for those who wish to sell them before maturity.

A inflation also plays a crucial role. If expected inflation increases, investors tend to demand higher returns as compensation.

This means that bonds with fixed rates may lose their attractiveness if inflation rises above expectations after their purchase.

In general, fixed income securities long term offer higher returns than short-term ones.

Reflecting the greater risk assumed by the investor when committing to an investment for a longer period.

Links to useful tools for fixed income investors:

– [Direct Treasury Calculator]

– [Investment Simulator]

O credit rating of the issuer can significantly affect the return on investment.

Emissions from companies or governments with high credit rating are considered less risky, which generally results in lower returns.

On the other hand, securities from issuers with low rating offer higher returns, reflecting the higher risk of default.

In short, before investing in fixed income, it is important to consider these and other factors that can influence the return on investment.

Online financial tools and calculators can be helpful in projecting income and making informed decisions.