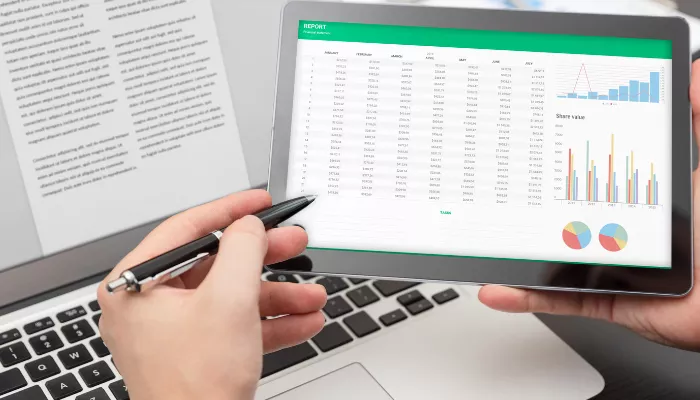

Learning how to manage fixed income investments can be challenging for beginners. However, a fixed income spreadsheet can greatly simplify this process.

Let's explore how you can use this feature to make more informed choices and monitor your investments efficiently.

One fixed income spreadsheet is a digital tool designed to help investors organize, track and analyze their investments

In fixed income securities, such as CDBs, Tesouro Direto, LCIs, LCAs, among others. It allows you to clearly view the yield, terms and fees of each investment.

By centralizing your investment information in a spreadsheet, you can make more informed decisions.

Comparing yield rates and maturities between different options becomes easier, helping you choose investments that best fit your financial objectives and deadlines.

Additionally, regularly updating your spreadsheet with your earnings allows you to see your portfolio's progress and make adjustments as needed to maximize profits.

Although it may seem complex at first, with practice, the fixed income spreadsheet becomes a powerful ally for the beginning investor.

It not only simplifies investment management but also provides a detailed view of the growth of your assets over time.

Select the best options Fixed income investment can seem like a complex task, but with the right tools.

As a financial analysis spreadsheet, this process can become simple and very effective. See how you can make this choice in an informed and safe way.

First, it is important categorize types of investments available fixed income. This includes CDBs, LCIs, LCAs, Tesouro Direto, among others.

In your spreadsheet, dedicate a section to list these categories, including details such as maturity date, expected rates of return, and risk levels.

A crucial part of choosing fixed income investments is clearly define your financial goals. Are you looking for security, liquidity or maximizing returns? Depending on your goals, some investments will be more attractive than others. Use your spreadsheet to record your goals and compare them to the characteristics of each investment option.

To the return rates are fundamental to understanding the potential of each investment. Use your spreadsheet to compile the interest rates offered by different options.

Remember to consider the impact of inflation and taxes on these rates to calculate the expected real return.

Risk is another decisive factor. Some fixed income options are guaranteed by the FGC (Credit Guarantee Fund), while others, such as public bonds, are guaranteed by the National Treasury.

Document the level of risk associated with each investment in the spreadsheet to ensure it is aligned with your investor profile.

With these strategies, your spreadsheet will become a powerful tool for choosing the best fixed income investments, according to your own criteria and needs.

By keeping the spreadsheet updated and reviewing it periodically, you maximize your chances of success in the investment world.

Links to applications or websites mentioned in the content:

To maximize your profits in fixed income investments, the use of a control spreadsheet is essential.

This feature allows you to monitor and analyze your investments in detail, helping you make more informed and strategic decisions.

An efficient spreadsheet gives you a complete view of your investments, including return rates, maturity dates, and periodic contributions.

Furthermore, it is an excellent tool for comparing different investment options, understanding which one best suits your financial objectives and risk profile.

With an effective spreadsheet, you can identify reinvestment opportunities, transferring resources from lower-yielding investments to more profitable options.

Furthermore, by centralizing information, you avoid missing important deadlines and make decisions based on data, not assumptions, thus increasing your profits consistently.

To start your control spreadsheet, you can use some very useful online resources such as Microsoft Excel, Google Sheets, and specific investment management tools such as Morningstar.

In conclusion, the use of a fixed income investment control spreadsheet It's a smart strategy for anyone who wants to optimize their returns.

With the right tools and information, you can maximize your profits and reach your financial goals more effectively.